Income tax and city/prefectural tax returns [Application period: February 17 to March 17 ] 所得税と市県民税の申告書:受付期間:2月17日~3月17日

- [公開日:2025年2月4日]

- [更新日:2025年2月4日]

- ID:15269

ソーシャルサイトへのリンクは別ウィンドウで開きます

Create your own income tax and city/prefectural tax returns, submit them early. [Application acceptance period: February 17 (Monday) to March 17 (Monday)]

We are accepting income tax returns and city and prefectural tax returns for the year 2024 (January 1st to December 31st). If you need to file a return, please complete the procedure within the period.

For tax returns from 2023 onwards, if you wish to claim a dependent deduction for a person residing outside of Japan as a dependent, you will not be able to file at the Nagahama City Hall filing venue. Please file at the Nagahama Tax Office (Nagahama Zeimusho).

Persons who need to file an income tax return

● People who have salary income and who fall under any of the following

・ Persons whose income other than salary (excluding retirement income) exceeds 200,000 yen

・ People who receive salaries from two or more places

・ Persons whose salary income exceeds 20 million yen in 2024

・ Persons who haven't finished the year-end tax adjustment at the place of work.

・ Persons who complete the year-end adjustment and add or change deductions such as medical expense deductions.

●Persons who mainly have pension income

・Persons who earn more than 4 million yen

・Persons with income of 4 million yen or less and income other than pension income of 200,000 yen or more

Persons who need to declare city and prefectural tax

●Only income that will be no income or tax exempt in 2024 (survivor's pension, disability pension, etc.)

・Persons who are not dependent on anyone

・Persons who are tax dependents of a relative living outside the city

●Persons mainly with pension income of 4 million yen or less

・Persons who only have pension income and have deductions to declare

・Persons who mainly have pension income or non-pension income (less than 200,000 yen)

●Mainly people with salary income or non-salary income of 200,000 yen or less

※Persons who have completed their final tax return do not need to file a city/prefectural tax return.

※Persons who are subject to city and prefectural tax returns and who receive income tax refunds must file a final tax return.

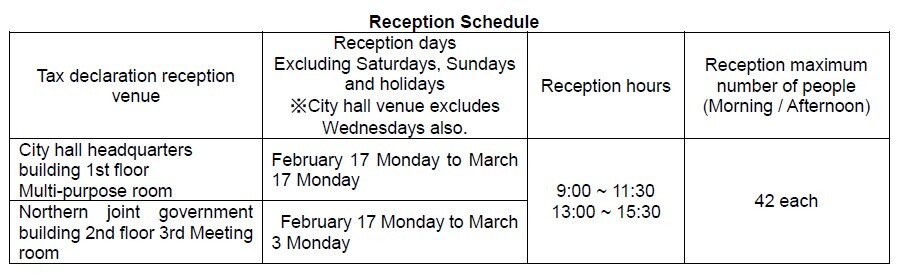

※Nagahama city hall venue will not be open every Wednesday.

Reception Schedule

(Reception Schedule)

Reservation method

[Reservations open] February 12 Wednesday, from 9AM

[How to make a reservation]

Please make a reservation in advance using one of the following methods.

※Please pay for communication costs.

※Numbered tickets will not be distributed on the day.

※Reservations cannot be made directly at the City Hall counter.

《LINE》

After registering as a friend on Nagahama City's official LINE account, make a reservation from "Income Tax/Municipal/Prefectural Tax Filing Reservation" in the "Procedures/Research" menu.

《Web》

You can make a reservation online. You will need an email address to make a reservation.

https://e.kanameto.me/wreserve/nagahama_yoyaku/error/4

《Telephone/Call Center》Navi dial TEL 0570-000-374

Reception: 9;00-16;45 (excluding weekends and holidays)

[About canceling or changing reservations] Inquiries: Tax return reservation call center (0570-000-374)

・ Please come to the venue by the reservation reception time. If you come after the reservation time, we will not be able to accept your declaration at the venue on the day.

・ LINE and web reservations can be canceled up until the day before.

To cancel on the day, please contact the tax return reservation call center (this applies to all LINE, web, and phone).

・ Depending on the reservation situation, the order may change.

What to bring for Tax declaration

□Something that shows your individual number (My Number card, resident card with individual number, etc.)

□Identity verification documents (residence card, driver's license, etc.)

□Document showing user identification number (person filing final tax return)

※Please bring copies of the previous year's tax return, documents and postcards sent by the Tax Division or Tax Office if you have them.

□If you do not have the original withholding slip for salary or public pension, you must submit the original salary payment certificate.

□Income and expenditure statement (for people with business income, agricultural income, real estate income, etc.) If it has not been created, it will not be accepted. Please prepare the documents in advance.

□If you are claiming medical expense deduction, you must attach a ``Medical Expense Deduction Statement.'' Please be sure to calculate the total amount of medical expenses paid during 2023 in advance and prepare a "Medical Expense Deduction Statement" before coming to file your tax return. If the statement has not been created, we will not be able to accept it.

□Those who wish to receive special spousal deduction must submit documents showing their spouse's income, such as withholding tax slips.

□Those who receive the disability deduction must present a disability certificate or rehabilitation certificate.

□Those who receive the insurance premium deduction must present a deduction (payment) certificate for life insurance premiums, earthquake insurance premiums, (former) Nagahama Insurance Premiums, and national pension insurance premiums, as well as documents showing the amount of health insurance premiums.

□If you are applying for a refund, bring something that shows the bank account in your name (passbook, etc.)

Inquiries

City Hall Tax Division: 0749-65-6524

Nagahama Tax Office: 0749-62-6144

お問い合わせ

長浜市市民協働部市民活躍課

電話: 0749-65-8711

ファックス: 0749-65-6571

電話番号のかけ間違いにご注意ください!